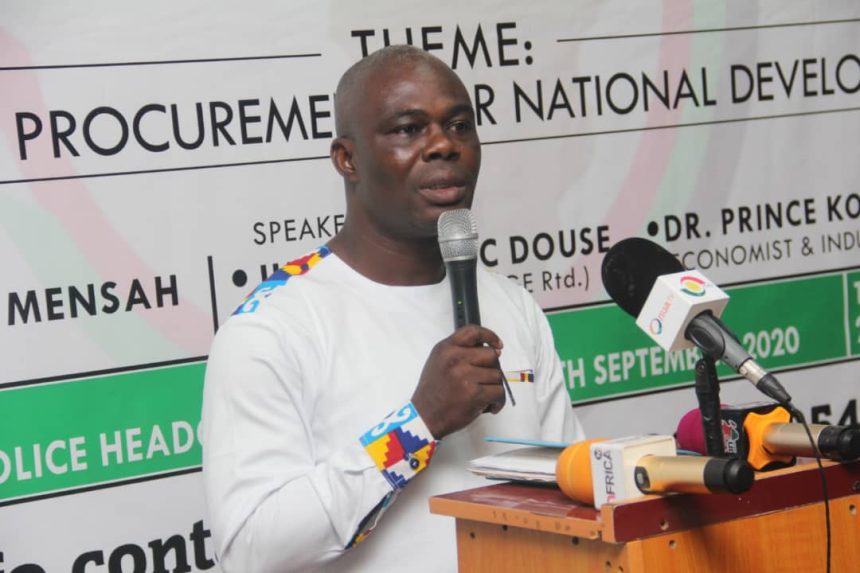

Financial Economist, Dr. Sam Worlanyoh Mensah has condemned the Government for creating new taxes to generate revenue for national income.

He was speaking on the implementation of three new taxes on 1st May, 2023. These taxes are the Excise Amendment Act, Income Tax Amendment Act, and the Growth and Sustainability Levy Act, 2023.

These new taxes require that a percentage of profits earned by some goods and services be paid as taxes to the government to generate revenue for national development.

Concerns are being raised by the general public over the introduction of the new taxes and reduction in profit gains which may in turn lead to higher cost of living.

Speaking to UniversNews, Dr. Mensah expressed displeasure over the introduction of the new taxes as he mentioned some of the detriment that comes with introducing new taxes in the society.

“Introduction of new taxes definitely increase the cost of living, also increases the cost of doing business. And once cost of living is increasing, definitely affects standard of living. So standard of living becomes low and makes life become more complex. Prices of goods and services will continue to rise and the ordinary citizens will continue to suffer. So in that regard, you have two major effects. One is that it allows government to have some appreciable level of revenue generation. But after a short while that revenue will also decline because it will definitely affect productivity. Once companies are going to pay more taxes it’s going to take away their profits.”

Noting that the introduction of taxes may be an IMF condition for credit, Dr. Mensah advised the government to realign existing taxes instead of introducing new ones.

He added that government can use digital means to socially restructure the taxing process in the country and encourage citizens to contribute effectively to national development.

“But I think it’s not because government deemed it necessary to increase taxes, but because it’s an IMF conditionality that they need to enforce so that they’ll be able to have access to the credit facility from IMF. I believe governments should rather do social and economic reengineering through the digitization process. Digitization is meant for us to reprofy the country so that we know each Ghanaian where they live and what they for living, and be able to compel them to contribute towards national development. So what I urge government to do is to stop imposing more taxes, rather let’s do realignment, let’s overhaul the system.”